Pros and Cons of Texas Homeowners Insurance

Writing that monthly check for homeowners insurance can be painful, especially in Texas where the cost of insurance is high. While painful, homeowners insurance is a requirement for most of us. If you have a mortgage on your home your lender will require that you carry coverage in order to protect their investment. Once you have paid off your mortgage, insurance become optional but dumping your coverage can be a major financial mistake.

The majority of homeowners realize just how important coverage is with roughly 98 percent of homeowners with a mortgage carrying homeowners insurance according to data from the Insurance Information Institute (III). A fire, storm or lawsuit can quickly drain your savings account if you are unprotected by insurance.

People who drop homeowners insurance (only 3 percent of homeowners are doing this) are simply unable to afford the monthly payments or are wealthy enough to self-insure their own properties.

Unfortunately, Texas is a very expensive state for homeowners insurance. According to ValuePenguin, the Lone Star state is the second most expensive state in the country for homeowners insurance, right behind Florida. Their data shows that the median cost of a homeowners policy in Texas is $1,947, which is a whopping 80 percent more than the national average.

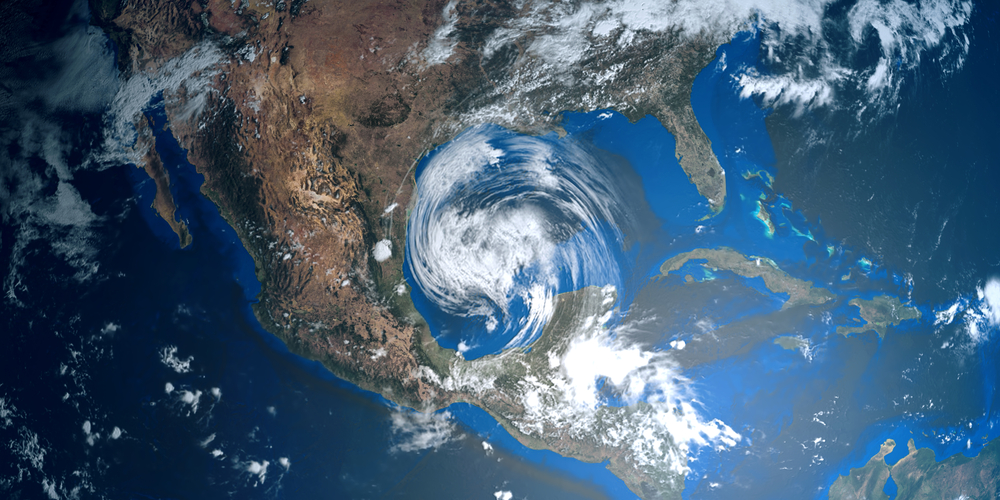

The Texas coast gets its fair share of severe weather, with hurricanes and tornadoes occurring regularly. One of the worst storms to hit Texas was Hurricane Harvey, which hit in 2017. Harvey caused $125 billion in damage and ranks as the second most expensive hurricane to hit the United States.

The high cost of insurance in Texas is mainly due to these types of severe storms, which means that homeowners in coastal cities such as Galveston, Corpus Christi, or Brownsville will usually be paying an even higher premium, pushing homeowners insurance into the unaffordable category.

If you are considering dumping your coverage because your premium has become a financial burden or you have paid off your mortgage, we highly recommend you take a few minutes to consider the risks of going without insurance. If you are unable to easily cover the cost of rebuilding or repairing your home after a major incident you should not drop your homeowners insurance.

We thought it would be a good idea to have a look at the pros (there is only one) and the cons (there are a number of them) to living insurance free.

The Pros Are a Short List

Putting a little extra coin in your pocket is really the only pro to dropping homeowners coverage.

Saving Money: Saving money is the only real advantage to dropping your coverage and in Texas that can be a big incentive. While sticking $162 a month back into your savings account sounds like a good idea, is it really worth putting your home and savings at risk?

Make no mistake, dropping your homeowners insurance is a major risk. You would be on the hook for any repairs, or in the event of a major event, rebuilding your home if it is hit by a storm, fire or other covered peril. In addition to these risks, when you drop your homeowners policy you are on your own if a guest is injured in your house. Medical bills can quickly spiral out of control and if the injured person decides to sue all of your legal bills and any settlements will fall to you.

This can be financially devastating and unless you are able to easily cover the cost to rebuild your home and replace your possessions you should be carrying a homeowners insurance policy.

Dumping Coverage Can Be Costly

There are a number of reasons to keep your insurance policy in place.

Rebuilding and Repair Costs: This is probably the number one reason to keep your Texas homeowners policy in place. Repair costs can reach into the tens of thousands of dollars if your home is damaged by a storm. In a worst-case scenario, you could be on the hook for the cost to rebuild your entire home. These types of expenses can drain your retirement savings or force you to sell other assets to cover the costs.

Even if you live away from the coast in one of our beautiful inland such as Austin, San Antonio, or Dallas the risk of severe weather damage (hail and wind for example), a fire or a lawsuit from an injured guest still exists.

Zillow pegs the median home value in Texas at $191,900 but that price can be much higher on the coast or in the heart of our big cities. If your home is destroyed by a fire or severe storm you will be forking up the $190,000 or more to get your home and life back together.

It’s important to remember that homeowners insurance not only covers your house but any detached structures on your property. This includes outbuildings, sheds, barns or detached garages. However, there can be coverage limits to this type of coverage so make sure you check with your insurance agent about your policy limits.

Liability Protection: This can be one of the biggest risks to going without coverage. If a guest is injured on your property you may end up covering their medical bills as well as legal fees if they decide to sue. If the injury is serious these costs can run into the millions of dollars, putting all of your assets (not just your house) at risk.

Ask yourself if saving $2,000 a year is worth losing your retirement savings and other assets that you acquired over your lifetime.

Living Expenses: This portion of a homeowners policy helps cover the cost of your day to day living expenses in the event your home is deemed unlivable due to a covered peril such as a fire or weather damage. It will help pay for hotel bills, restaurant costs and even laundry.

Replacing Your Possessions: Your home is filled with all of the possessions you have acquired over the years and if you are uninsured it will be your responsibility to replace them all. Take a look around your home and imagine what it would cost to replace everything you own, can you easily cover that cost? If the answer is no, you should be carrying a homeowners insurance policy.

Crime rates vary widely across Texas but according to Neighborhood Scout, Texas residents have a 1 in 35 chance of being the victim of a property crime. This amounts to roughly 135,000 burglaries a year. If you are hit by a burglar you will be responsible for replacing all of your items.

Homeowners policies do have a caps on luxury items such as jewelry, artwork, collectibles, firearms and even wine collections. While the cap can vary by insurer, $1,500 is a fairly common number. If you have high value items that exceed this amount you may need to purchase a rider to fully protect all of your possessions.

Final Homeowner Insurance Tips

Here are a few final tips when it comes to homeowners insurance:

Flood and Earthquake Damage Not Covered: Many homeowners make the mistake of thinking that a homeowners policy covers all types of damage but this is not true. A standard homeowers policy excludes damage that is caused by an earthquake or flooding. If your home is located in a high-risk flood area you will need a separate flood insurance policy to fully protect your home. While flood insurance can be expensive, it is well worth the cost if your home is flooded.

Raise Your Deductible: This is a great way to lower your premium. Insurers are happy to discount your premium if you have more skin in the game. If you can afford to double your deductible you should see your premium go down roughly 10-20 percent. Always choose a deductible that you can easily afford in the event you have to make a claim.

Discounts Are Your Friend: Insurance companies offer a variety of discounts and these can be a great way to lower your premium. Ask your agent to do a discount review to make sure you are getting all of the discounts that you are entitled to receive.

Shop Around: This is probably the best way to lower your premium. Insurers rate risk differently and this can result in dramatically different policy quotes. Always compare apples to apples when it comes to coverage levels and deductibles. And easily allow HomeInsuranceKing.com to shop and compare the best rates and coverage options for you all-in-one place. Get Texas Homeowners Insurance Quotes Today!