Compare quotes for your home in Florida! It's easy and only takes a minute! Compare up to 12 carriers.

Florida Homeowners Insurance Quotes

Florida is a great state to call home. Regardless of whether you are looking to live at the beach, or something a little further inland, Florida has everything you need to have a great life and raise a family.

The outdoor life is what Florida is all about. Obviously the ocean and beach are a huge draw but we also have three national parks and plenty of hiking and biking trails.

Florida is no slouch when it comes to cultural activities. The state is dotted with museums, festivals, opera houses and let's not forget the always fun Walt Disney World. In addition we have some of the best restaurants in the country.

If you are considering making the move down to Florida you can't go wrong. Our big cities such as Miami, Tallahassee and Orlando offer all the conveniences of a major metro area. On the other hand, if you're looking for a slower paced lifestyle, consider some of our smaller towns and villages such as Fort Myers, Sarasota or Jupiter.

No matter where you end up putting down roots, you are going to love your new Florida lifestyle.

2025 Florida Home Facts

As of 2025, the population of Florida has grown to an estimated 23.8 million residents. Millions of homeowners across the state are looking to find the best coverage and premium available for their home.

The housing market shows a median home price of about $425,000, an approximate 4% increase year-over-year.

Household income data based on recent figures report a median household income of roughly $75,630.

Meanwhile, homeowners in Florida face unusually high insurance costs: the average annual premium for homeowners insurance in 2025 is about $5,770 statewide.

Given the elevated insurance costs, owning a home in Florida carries a higher ongoing expense than many other states. Coastal and wind-exposed regions push premiums even higher, with some averages reaching over $10,000 annually depending on coverage and location.

While Florida residents will almost always pay more than the national average, here are a few ways to lower the costs of your homeowners insurance policy:

- Shop Your Coverage: This is probably the best way to lower your insurance cost. Insurance companies rate risk differently which means that premium quotes can vary dramatically. Make sure you're comparing apples to apples when it comes to deductibles and coverage levels when shopping for insurance. At GetHomeInsuranceQuotes.com, we can easily help you shop your coverage and compare up to 30 different carriers for the state of Florida.

- Discounts: Discounts are another great way to lower your insurance costs. This can be especially true in Florida. Upgrading your roof to wind resistant materials can result in a big discount, as can adding storm shutters. Ask your agent to run a discount review to make sure you're getting all available discounts.

- Raise Your Deductible: Pushing up your deductible is a guaranteed way to lower your premium. If you can afford it, doubling your deductible can result in a major premium drop. Always make sure you can afford your deductible amount in the event you have to make a claim.

Insurance Rates by Homeowners Insurance Type

There are a number of different types of homeowners insurance and each one is designed to insure a specific type of home. Here is an overview of the different types of homeowners insurance as well as the average Florida premium for each type according to data from NAIC:

Dwelling Fire: Dwelling fire insurance offers very basic coverage. It only covers damage due to smoke and fire although some policies will also cover damage that is due to vandalism, wind and explosions.

In the Sunshine State roughly 6.2 percent of policies are Dwelling Fire with the average premium coming in at a still pricey $1,819.

HO-2: An HO-2 policy is also a very basic policy. It covers damage from perils that are specifically listed in the policy wording. If the peril is not listed, your damage will not be covered.

In Florida, a mere 0.1 of policies are HO-2s. The average premium for these policy types is $2,033.

HO-3: This is considered the standard homeowners policy for single-family homes. It offers protection from all perils except those that are specifically excluded in the policy wording.

In all cases, flood and earthquake damage is excluded from a standard HO-3 policy. This can be particularly important in Florida where flood damage is common. If you live in a flood prone area you will need a separate flood insurance policy.

In Florida, 66.6% of homeowner policies are HO-3s. The average price for an HO-3 is $2,115 per year.

HO-4: This policy type also goes by the name renters insurance as it is designed to protect people who live in apartments. These policies cover your personal possessions as well as offer liability coverage in the event someone is injured in your apartment.

In Florida, 8.2 percent of policies are HO-4s according to the NAIC.

HO-5: An HO-5 policy is used to protect newer and more upscale houses. It not only protects your home but other structures on the property and covers your personal possessions against all perils, except those that are specifically excluded. In almost all cases, an HO-5 policy is not available for older homes

Roughly 0.4 percent of policies in Florida are HO-5s, which is probably due to their high cost, the average policy premium is $4,278.

HO-6: This policy is for owners of condos and co-ops. It covers your personal property as well as the structural components of the building that you own such as the walls in your particular condo or co-op. It should be noted that coverage is limited to 16 specific perils that are listed in the policy.

In Florida, 15 percent of policies are this type.

Florida Home Insurance Question & Answer

How much is home insurance coverage on a $400,000 house in Florida? - Around $4,800 per year depending on the coverage options you may need or choose to have on your policy. Rates can be much higher in areas like Fort Lauderdale. Rates can depend on how close you are to the coastline, your most recent claim history and the coverage levels on your policy will determine the final premium.

How much is homeowners insurance on a $600,000 house in Florida? - Around $6,500 per year depending on the coverage options, location and claims made on existing or previous policies.

Factors to Consider in Florida

While there are many factors that help push up the cost of homeowners insurance in Florida, here are three of the big ones:

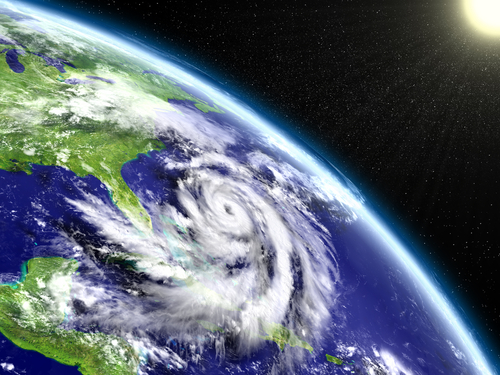

Hurricanes: Florida has seen a lot of hurricanes in its history. Despite the fact that it has been a number of years since a catastrophic hurricane has hit the coast of Florida, past hurricane damage still pushes up the cost of insurance dramatically. According to industry data, since 1983, there have been $67 billion in insured catastrophic losses in the state of Florida.

While there is little you can do to protect against a direct hurricane hit, adding storm shutters, or replacing your roof with wind resistant materials can help minimize damage from major windstorms or even the fringes of a hurricane. This will usually result in a discount from your insurance company.

Flooding: Flooding can often be the result of hurricanes as well as tropical storms. As an example, in 2012, Tropical Storm Debbie dumped roughly 15 inches of rain in parts of South Florida and in 2008 Tropical Storm Fay flooded some roads with up to 5 feet of water.

Flood damage can be extremely expensive and a standard homeowners policy will not cover damage due to flooding. While flood insurance can be purchased through a standard insurance agent, pricing is set by the National Flood Insurance Program. Depending on where your home is located, flood insurance can be extremely expensive, but can be a financial lifesaver if your home is damaged due to flooding.

Pools: Due to our hot temperatures, pools are pretty common in Florida. Unfortunately, pools can result in injuries, which can quickly lead to lawsuits. If you have a pool expect your premiums to go up at least $50 per month. Be sure to factor in these costs if you are considering a home that already has a pool or are thinking of putting a pool in at your current home.

If you’re making the move to the Sunshine State, you're making one of the best decisions of your life. Regardless of whether you settle in a major city such as Miami, Tampa, or Jacksonville or decide a smaller town like Port Charlotte, Bonita Springs or Everglades City is more your speed, you will need a brand new policy to cover your new Florida home.

We can easily help you shop and compare up to 30 different Florida home insurance premiums and apply all the available discounts and credits. Some of our most competitive home insurance companies in Florida include: Centauri Insurance, St. Johns Insurance Company, People's Trust, Heritage, Edison, Florida Peninsula, Olympus, American Integrity, Tower Hill, Anchor, Universal Property and Casualty and many more.

Get started today, easily request free Florida home insurance quotes and get the most competitive rates online now.

Local Florida Home Insurance Rates

Islamorada, FL Homeowners Insurance - Average Rates - $1584/yr.

Check out our recent homeowners in Islamorada, FL, competitive rate of $1584 per year. Average rates range from $1334 to $1884. See details on average rates within the city of Islamorada. - Get Islamorada Home Insurance Quotes! or Give us a call now at 1-855-976-2656

Miami, FL Homeowners Insurance - Average Rates - $1660/yr.

Check out our recent homeowners in Miami, FL, competitive rate of $1660 per year. Average rates range from $1410 to $1960. See details on average rates within the city of Miami. - Get Miami Home Insurance Quotes! or Give us a call now at 1-855-976-2656

Average Homeowners Insurance Premiums in FL

With over 95% of all Americans are known to have homeowners insurance coverage, it's important to know what FL homeowners are paying on average. Did you know that the average homeowners insurance premium in FL is $2677? FL is now ranked 1 in the country. The country wide average for homeowners in the United States is $1,311. This means the average home insurance premium in FL is 104.20% more than the national average.

| Year | Average Annual Premium | Average Monthly Premium | State Rank (Overall) |

|---|---|---|---|

| 2022 | $2677 (9.4%) | $ 223 | 1 |

| 2021 | $2437 (11.8%) | $ 203 | 1 |

| 2020 | $2165 (8.9%) | $ 180 | 1 |

| 2019 | $1988 (1.4%) | $ 166 | 3 |

| 2018 | $1960 (0.46%) | $ 163 | 2 |

| 2017 | $1951 (1.71%) | $ 163 | 2 |

| 2016 | $1918 (-3.84%) | $ 160 | 3 |

| 2015 | $1993 (-3.02%) | $ 166 | 1 |

| 2014 | $2055 (-2.84%) | $ 171 | 1 |

| 2013 | $2115 (1.49%) | $ 176 | 1 |

When we combine the state averages over the last decade, the FL overall average is estimated to be around $2,306.80. Our homeowners insurance quoting and rating process helps you compare homeowners insurance quotes, coverages and premiums. FL current state rank compare to the rest of the country is #1. Consider shopping your FL home insurance with us so we can help you save up to 40% or more on your policy.

Find Local FL Homeowners Insurance Quotes & Coverage

For more information on homeowners insurance in your area, choose a county below:

- Alachua

- Baker

- Bay

- Bradford

- Brevard

- Broward

- Calhoun

- Charlotte

- Citrus

- Clay

- Collier

- Columbia

- Desoto

- Dixie

- Duval

- Escambia

- Flagler

- Franklin

- Gadsden

- Gilchrist

- Glades

- Gulf

- Hamilton

- Hardee

- Hendry

- Hernando

- Highlands

- Hillsborough

- Holmes

- Indian River

- Jackson

- Jefferson

- Lafayette

- Lake

- Lee

- Leon

- Levy

- Liberty

- Madison

- Manatee

- Marion

- Martin

- Miami Dade

- Monroe

- Nassau

- Okaloosa

- Okeechobee

- Orange

- Osceola

- Palm Beach

- Pasco

- Pinellas

- Polk

- Putnam

- Saint Johns

- Saint Lucie

- Santa Rosa

- Sarasota

- Seminole

- Sumter

- Suwannee

- Taylor

- Union

- Volusia

- Wakulla

- Walton

- Washington

FL Homeowners Insurance News & Information

-

Florida Homeowners Can Cut Insurance Bills —Here’s How, and Which Companies are Worth a Look Posted on Tuesday 11th November, 2025

Florida homeowners have spent years paying some of the highest homeowner-insurance premiums in the nation. But the market is slowly stabilizing and there are concrete, immediate steps homeowners can take to shrink premiums — from simple paperwork to Florida’s “My Safe Florida Home” program — while shopping smarter for companies that combine strong service with […]

-

Homeowner’s Insurance Rates Spiking Over $3,000 a Year on Average Posted on Friday 19th September, 2025

According to a recent report by The Zebra, the average homeowner is paying roughly $3,000 a year for homeowners insurance. Unfortunately, this is just the nationwide average, in many states premiums are dramatically higher for most homeowners. According to the Zebra report, the most expensive states for homeowners insurance are: Nebraska: $7,920 Oklahoma: $7,426 Kansas: […]

-

Homeowner’s Insurance Premiums Skyrocket: Forcing Homeowners to Consider Moving Posted on Thursday 11th September, 2025

While states like Florida, California and Louisiana have seen climbing insurance costs for years due to severe weather, flooding and hurricanes, other states, Colorado and Illinois are good examples, are seeing climbing rates as well due to hailstorms and wildfires. As homeowner’s insurance premiums skyrocket, for some policyholders, the math no longer makes sense forcing […]

-

Homeowners in Florida Finally See Relief From Higher Insurance Costs Posted on Wednesday 27th August, 2025

According to a recent Realtor.com article, homeowners in Florida, at least some of them, may finally seem some relief from higher homeowner insurance costs. Florida Peninsula Insurance which is one of the largest private party property insurers recently announced that it is hoping to significantly lower premiums for roughly 170,000 policyholders. Florida Peninsula has filed […]

-

Florida Homeowners Are Concerned About Property Insurance Crisis Posted on Tuesday 1st July, 2025

Insurance rates are rising at unprecedented rates, causing millions of people to struggle with the new premiums. In the last three years, insurance rates have doubled in some areas. Homeowners fear for their houses while their representatives in Congress struggle to help. Insurers are pulling out of states like Florida as damaging hurricanes and powerful […]

-

How to Prepare Before Hurricanes Threaten Florida Posted on Monday 19th May, 2025

How to Prepare Before Hurricanes Threaten Florida Posted on Monday 19th May, 2025

Hurricane season is quickly approaching and one of the most important things to do before a storm hits is to make sure your insurance coverage is up to date and your coverage levels are sufficient in the event your home is damaged by severe weather. Regardless of whether you own a home or are renting, […]

-

New Home Insurance Company Launches in Florida, Shows Signs of Improvement Posted on Tuesday 13th May, 2025

According to Office of Insurance Regulation and leaders in the industry, Florida may finally be emerging from the insurance crisis that it has suffered through for the last decade. Insurance companies operating in the state are starting to stabilize rates and new insurance companies are entering the Florida market. Recently, the Office of Insurance Regulation […]

-

Florida Homeowners With Insurance Are Struggling to Get Claims Paid – Why? Posted on Wednesday 19th March, 2025

According to a recent Moneywise article, homeowners with insurance coverage in Florida are struggling to get claims paid. Chad Zalva, a single dad in Riverview, Florida, was cited as an example in the article as a homeowner who is carrying homeowners insurance but was recently surprised to learn that the damage to his home from […]

-

2025 List of States Where Finding Home Insurance Is Most Difficult and Why Posted on Tuesday 11th March, 2025

Homeowners insurance is a necessity if you own a home, particularly if you are currently carrying a mortgage. Mortgage lenders require homeowners insurance to protect their investment in your home by always carrying homeowners insurance. If your insurance is cancelled or you are non-renewed it can be a huge problem. As wildfires and major windstorms […]

-

Will Citizens Policyholders See a Home Insurance Rate Decrease? Posted on Tuesday 11th March, 2025

Will Citizens Policyholders See a Home Insurance Rate Decrease? Posted on Tuesday 11th March, 2025

Recently, Gov. Ron DeSantis announced that over 20% of Citizens property insurance policyholders will see a premium decrease of roughly 5.6%. DeSantis also claimed that almost 73% of homeowners who have a policy with Citizens in Miami-Dade County will see a rate reduction of 6.3% on average. The state-run insurer, Citizens Property is finally shedding […]

FL Housing & Real Estate Data

| Details: | Staticstics |

|---|---|

| Total Housing Units | 8989580 |

| Occupied Housing Units | 7420802 |

| Vacant Housing Units | 1568778 |

| Vacant Housing Units for Rent | 371626 |

| Vacant Housing Units Rented Not Occupied | 15438 |

| Vacant Housing Units For Sale | 198232 |

| Vacant Housing Units Sold Not Occupied | 31911 |

| Vacant Housing Units For Seasonal Occasional Use | 657070 |

| Vacant Housing Units All Other Vacants | 294501 |

| Housing Units Homeowner Vacancy Rate Percent | 3.8 |

| Housing Units Rental Vacancy Rate Percent | 13.2 |

| Housing Tenure Occupied Units | 7420802 |

| Housing Tenure Occupied Units Owner Occupied | 4998979 |

| Housing Tenure Occupied Units Owner Occupied Population | 12351838 |

| Housing Tenure Occupied Units Owner Occupied Averge Household Size | 2.47 |

| Housing Tenure Occupied Units Renter Occupied | 2421823 |

| Housing Tenure Occupied Units Renter Occupied Population | 6027763 |

| Housing Tenure Occupied Units Renter Occupied Average Household Size | 2.49 |

Understanding FL Homeowners Insurance

When shopping for FL homeowners insurance quotes you should be aware of the various types of insurance policies that are available in your area:

- HO-3: This is the most common type of homeowers policy. This policy type protects your home against all perils, except ones that are specifically excluded. In most cases earthquake and flood damage are excluded.

- H0-6: This policy type is specifically written for condos or co-ops. If you own a condo or live in a co-op building this type of policy is a necessity. A HO-6 policy covers both your personal belongings and the structural parts of the building that you own. There are 16 disasters listed on a typical policy that HO-6 protects against.

- HO-4: If you are looking for FL renters insurance, a HO-4 policy is a great option. Renters insurance will cover your contents as well as offer liability coverage in the event a person is injured in your apartment.

While other types of policies exist, these are the most common ones. A HO-2 is a more basic policy that offers reduced coverage levels and a HO-5 is a high-end policy that offers increased protection.

If you are shopping for a new home in FL, homeowners insurance is a must do. We can help you find the perfect policy for your new home, regardless of whether you need a standard HO-3 policy, HO-6 or renters insurance, our site makes shopping for homeowners insurance quotes easy. Visit our online quoting application today and let us help you shop and compare up to 12 different FL rates and coverage options.