What You Need to Know About Earthquake Insurance

California has seen a number of earthquakes recently and while none of them have done significant damage, many experts predict the “big one” may be on its way. We thought it might be a good idea to do a general review on earthquake insurance and why it is a great coverage to carry if you live in an earthquake prone area.

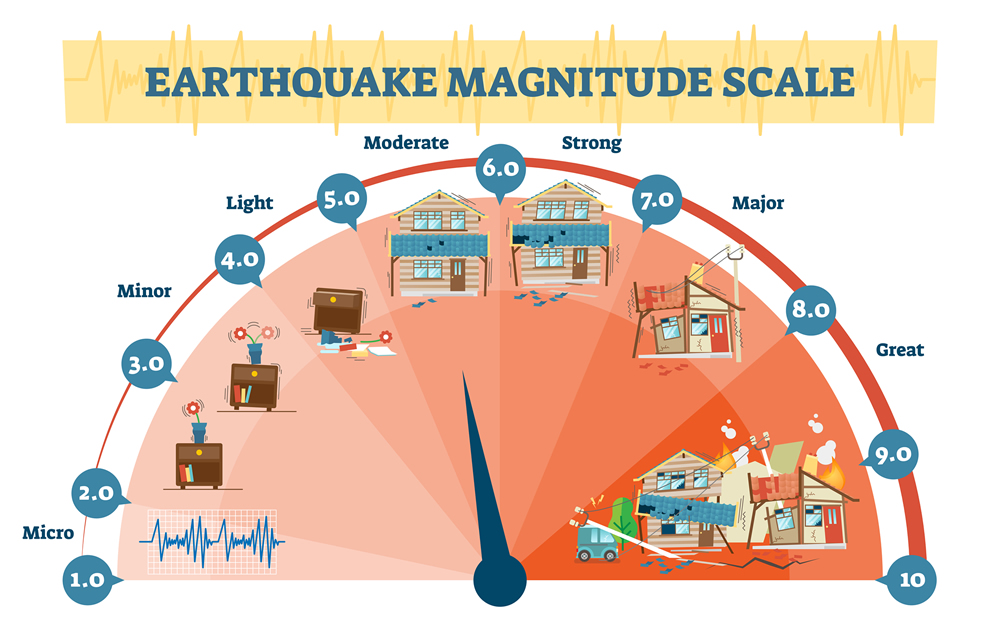

According to the U.S. Geological Survey, almost 200,000 earthquakes happen each year and the majority of them take place in 42 states that are considered risky for earthquakes. The majority of these earthquakes are small and usually go unnoticed. However, some are absolutely felt and cause damage to homes.

Here is what you need to know about earthquake insurance:

What Does Earthquake Insurance Cover

Earthquake insurance is designed to cover damage that is caused by an earthquake which is defined as a violent and sudden shaking of the ground due to movement of the earth’s crust. Damage done by an earthquake is almost always excluded from a standard homeowners policy. You must purchase a separate earthquake policy or have an earthquake endorsement on your homeowner policy.

Earthquake insurance will help cover the cost of damage that you experience from an earthquake. There are three big components of earthquake insurance:

- Dwelling Coverage: This portion of the policy will pay to repair or rebuild your home if it is damaged or destroyed by an earthquake. This portion of the coverage (like a homeowners policy) has coverage limits which you choose when you purchase the policy as well as a deductible. Earthquake insurance typically comes with a percentage deductible which is different than a standard deductible, we will talk about percentage deductibles in the next section. Always make sure you fully understand your responsibility with the deductible before purchasing an earthquake policy. Helpful Link: What is Dwelling Coverage and How Much Should I Carry?

- Personal Property Coverage: This portion of the policy will replace your personal property that is damaged or destroyed by an earthquake. This includes things like furniture, electronics, books, and all of your other personal belongings. This protection comes with a coverage limit that is usually a percentage of your dwelling coverage.

Make sure that the personal property portion of your policy will cover the cost of all your personal property in the event you home is destroyed by an earthquake. Always keep an up to date inventory off site or in the cloud, this will ensure your claim is paid quickly and fairly.

- Additional Living Expenses: This section of the policy will help cover your day to day expenses if your home is unlivable due to damage from an earthquake. This covers items such as restaurant and hotel bills as well everyday expenses such as dry cleaning. This coverage can be a financial lifesaver if you are out of your home for months or even a year due to earthquake damage.

- Exclusions: Like all insurance policies, earthquake insurance comes with exclusions. Flood damage that may occur from a tsunami or other flood damage will not be covered. If you are at risk from flooding you will need a separate flood insurance policy.

The same exclusion applies to fire damage that is a result of an earthquake. This type of damage should be covered under your standard homeowners policy. Finally, some outdoor damage is not covered, items such as pools, fencing and landscaping is usually not covered by an earthquake policy.

Earthquake Insurance Deductibles

When it comes to the deductible, most earthquake insurance policies have a percentage deductible and in the majority of cases it is fairly high. A typical policy will have a deductible between 10% and 15% percent of your coverage limits. In some states you may find deductibles as low as 2 percent but in states where earthquakes are common (think California and Oregon) you will be hard pressed to find a deductible under 10 percent.

Here is an example of a percentage deductible:

If you are carrying $250,000 worth of dwelling coverage with a 10 percent deductible you will have to cover $25,000 worth of damage if your home is destroyed by an earthquake. This number jumps to $37,500 if you are carrying a policy with a 15 percent deductible. While this may seem like a major expense (and it is) it certainly beats covering the entire cost to rebuild your home.

It is possible to lower your deductible in most states, but it will dramatically increase the cost of coverage. Always make sure that you choose a deductible you can afford in the event you have to make a claim.

Do You Need Earthquake Insurance?

Earthquake insurance is expensive and comes with a high deductible but if you live in an earthquake prone area it is almost always worth the cost. There are 42 states that are considered at risk for earthquakes but these 16 have the highest risk and have recorded earthquakes with a magnitude of 6 or greater:

- Alaska

- Idaho

- Montana

- Tennessee

- Arkansas

- Illinois

- Nevada

- Utah

- California

- Kentucky

- Oregon

- Washington

- Hawaii

- Missouri

- South Carolina

- Wyoming

If you live in one of these states, you should absolutely consider earthquake insurance. In other states, it pays to talk to your insurance agent about earthquake insurance and whether or not it makes sense for where you live.

Another factor to consider is whether or not you can afford to easily cover the cost to repair or rebuild your home after an earthquake. If the answer is yes, you may not need to carry earthquake coverage but if they answer is no (most of us fall into this category), you should consider a policy.

The cost of earthquake insurance can vary dramatically between states and even cities. In California, which is very earthquake prone, you can end up paying roughly $15.00 for $1,000 of coverage which translates into an annual premium of $3,750 for $250,000 worth of coverage. This can easily exceed the cost of your homeowners insurance policy.

In less earthquake prone areas, coverage can cost $.50 to $1.75 per $1,000 worth of coverage. The location of your home is not the only factor that insurers consider. The age of your home, the material it is constructed out of as well as the number of stories will push your premium up or down.

It is possible to retrofit an older home to help lower your insurance costs. This can include bolting the house to the foundation, bracing the chimney and installing automatic gas cut off valves which reduces the chance of gas leaks and fires.

The Bottom Line

Only you can decide if you need and can afford an earthquake insurance policy. While earthquake insurance is absolutely an expensive coverage, if your entire home is destroyed or even severely damaged you could find yourself on the hook for the entire cost to rebuild or repair your home. In the event of a catastrophic earthquake, an earthquake policy can be a financial lifesaver and well worth the cost.