Help Explain Flood Insurance Revamp – Risk Rating 2.0

For Free Flood Insurance Quotes, Please Call Us at 888-620-1954!

New, revamped flood insurance rates for the National Flood Insurance Program (NFIP) will be going into effect this month with the goal of charging flood insurance premiums that more accurately reflect the risk presented by the home. The new program could dramatically raise rates for large homes located on the coast while also reducing rates for homeowners a bit further inland with smaller houses.

FEMA has said that the new formula corrects the issue of lower cost homeowners subsidizing the price of flood insurance for larger, more expensive waterfront properties. “This is about fairness,” said Craig Fugate, former FEMA administrator under President Barack Obama in a recent Associated Press article. “People should be paying what their risk is.”

NFIP flood insurance policies are often the only option available in areas that are prone to hurricanes and other severe weather. FEMA underwrites the policies that are sold by traditional insurance agents. In many areas, private insurers have pulled out, leaving NFIP as the only option for homeowners.

The new pricing program is called Risk Rating 2 and new premiums will take effect this Friday for new policies while existing policyholders have until April 2022 until they see rate increases.

What is different in Risk Rating 2.0?

The major difference with Risk Rating 2.0 is that it looks at numerous variables specific to the home, not just its location on a flood zone map. Previously, the NFIP would base rates on a property’s elevation and whether or not it was located in a flood zone.

Rating Risk 2.0 will look at other factors that can cause flooding such as rivers overflowing, storm surge, heavy rain, and coastal erosion. It also takes into account how far away the home is from a water source, leading to lower rates for more inland homeowners.

In addition, Risk Rating 2.0 considers the size of the home as well as the cost to rebuild it which should lead to lower rates for smaller houses.

Whose rates are going up?

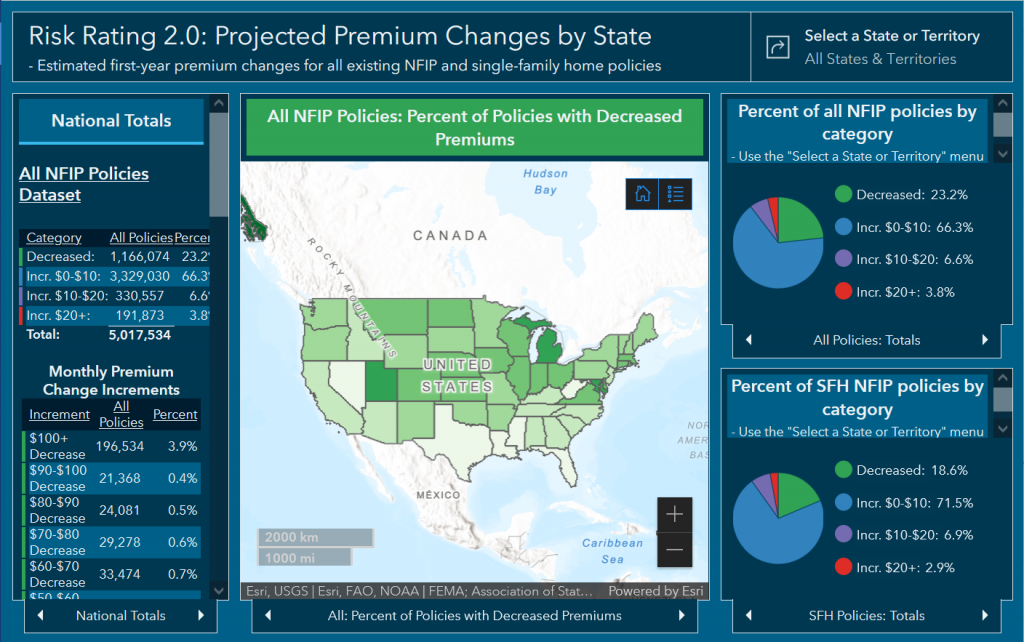

Currently, 3.4 million single family homes are protected by a NFIP policy, and the average premium is $739. Risk Rating 2.0 will lower premiums for roughly 625,000 homeowners while the remaining policyholders will see an increase or a premium that stays the same. Premium increases will be limited to 18 percent per year.

According to FEMA, the majority of rates hikes in the first year of the program will not exceed $120 but 3 percent of the policies will increase by more than $240 and will keep rising until the new target premium is reached.

It is predicted that coastal areas in California, Florida, Louisiana, New Jersey, New York, South Carolina and Texas will see the biggest rate increases due to their severe weather risk.

Currently, the NFIP has only released pricing information for the first year of the change, not disclosing the eventual target premium. If you currently have a NFIP policy, you should contact your insurance agent to see if your premium will be increase and what you can expect going forward.

Homeowners can also visit FEMA’s floodsmart.gov site for general information about the program, what it covers and how to purchase insurance.

For Free Flood Insurance Quotes, Please Call Us at 888-620-1954!