Does Florida Homeowners Insurance Cover Sinkholes?

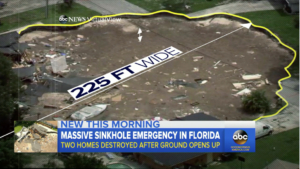

Massive sinkhole in Florida

A sinkhole in Pasco County, Florida grew to 225 feet wide and over 50 feet deep, swallowing two homes and a boat last week. A third home was considered to be in danger of also being sucked into the sinkhole.

Sinkholes can do an extreme amount of damage in a very short amount of time and often come out of nowhere.

So what happens if a sinkhole swallows your home, will your insurance cover the damage?

Luckily, if you live in the state of Florida, you should be covered if your home is destroyed by a sinkhole. According to local agents, all homeowner policies in the Sunshine State protect you from catastrophic ground collapse.

The gap in coverage occurs when a small sinkhole causes minor cracking in your homes foundation, in this case you may not have coverage and the cost to repair the damage will fall to you.

Sinkhole Riders

In some cases, a sinkhole will cause the ground to sink very slowly and cause cracks in the foundation of the house. In some cases these cracks can simply be caused by settling of the home but either way they can end up causing significant damage to the house and its foundation.

This is where a sinkhole rider comes in handy. It will usually cover the cost of repairing the damage regardless of whether it is caused by a sinkhole or foundation settling.

Unfortunately, if your home is already showing small cracks, most insurance companies will turn you down for a sinkhole rider. The majority of insurers require a home inspection done by a structural engineer before they will approve a policy and they also have very strict guidelines regarding policy approvals.

The cost for a sinkhole rider can vary depending on your home and its location but expect to pay at least $100 a year for coverage and roughly $150 to cover the cost of the inspection which you will have to cover. In most cases, this is small price to pay to protect your house from what can be very expensive foundation cracks.

Should I Get a Sinkhole Rider?

Every situation is different, and if there has never been a sinkhole in your area, in most cases you will be fine with a standard homeowners policy. However, because a sinkhole rider is fairly affordable, and foundation issues can be extremely expensive, you may want to seriously consider adding this protection to your insurance portfolio.

It can be very difficult to predict sinkholes or determine if your current home, or one that you are considering purchasing will end up with a sinkhole issue.

Experts advise having a structural engineer inspect any property you are considering. Talk to neighbors and check the local permitting office as well. Sellers are required to disclose any sinkholes or settlements on the property. Your realtor should also run a CLUE report, which should show any sinkholes in the area but experts warn that these reports are not always 100 percent accurate.

How Common Are Sinkholes?

They are not as common as most people think according to most experts. In a recent ClickOrlando.com article local Winter Springs real estate agent Kim Coburn said that she has seen very few sinkholes over the years.

“In 35 years in my career, I know of maybe six or seven in the Seminole County area,” she said in the article. “They do occur, she continued, but the vast majority of homes are not affected. I don’t think you have to really worry about sinkholes anymore than you have to worry about a hurricane.”

While sinkholes are not an everyday occurrence, insurance claims for sinkhole related issues are on the rise in Florida. According to a report generated by the state, sinkhole claims rose from 2,360 in 2006 to 6,694 in 2010. The amount of these claims totaled roughly $1.4 billion.

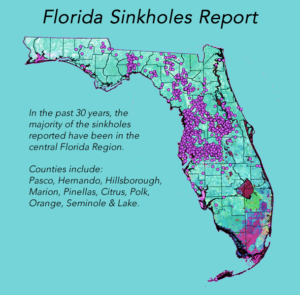

In the past 30 years, the majority of the sinkholes reported have been in central Florida.

A company called RiskMeter has created a sinkhole database and have determined that the following counties are the most sinkhole-prone Counties in Florida:

If your home is located in one of these counties you should seriously consider a sinkhole rider.

What Should I Do About Cracking?

If you see cracking in your walls or ceiling you should contact a structural engineer for an inspection. In the majority of cases, wall and ceiling cracks are caused by settling and not a sinkhole, but sinkholes do occur so all cracks should be taken seriously and investigated.

If a sinkhole appears on your property, follow all of the instructions a structural engineer gives you. According to news reports, the homeowner whose home was swallowed by the giant sinkhole in Pasco County was advised to fill the sinkhole which, had opened once before, with concrete or compacted grout but the homeowner took a cheaper route using pin piles which obviously did not work.

While using a cheaper method of repairing or filling a sinkhole may seem like a good idea at the time, it can be an expensive mistake if the sinkhole opens again. It is possible that your insurance company will deny any future sinkhole related claims if you do not follow an engineers advice.

Get the home insurance coverage you need fast, simply start comparing your Florida home insurance quotes today! Or give us a call now at 888-685-4704!