Flood Zones: How to Determine If You Need to Carry Flood Insurance

Flood insurance can be a financial lifesaver if your home is flooded and, in some cases, carrying flood protection is required. If your home is located in specific flood zones, you will be required to cover flood insurance and in many cases your lender may require flood coverage if they feel the home is at risk of flooding.

Knowing whether you need to carry coverage can be confusing. We thought it might be a good idea to have a closer look at flood zones and how to determine if you need to carry flood insurance. Keep reading to learn everything you need to know about flood zones and insurance.

FEMA Flood Zones

While FEMA recently rolled out a new program called Risk Rating 2.0 which takes more factors into account when setting a premium for your flood insurance policy, it still relies on flood maps to determine if you are required to purchase flood coverage.

FEMA and the National Flood Insurance Program (NFIP) have 14 different flood zone categories and some of them require homeowners to carry flood insurance while others don’t. Following is a quick breakdown of the various categories, but to make things simple, if your zone starts with a letter A or V you will have to purchase flood insurance.

- B and X (shaded): Flood insurance is not required

- C and X (unshaded): Flood insurance is not required

- D: Flood insurance is not required

- A, AE, AR, A1-30, A99: Flood insurance is required

- AH: Flood insurance is required

- AO: Flood insurance is required

- V, VE, V1-V30: Flood insurance is required

It should be noted that flood zones reflect the likelihood of a flood occurring in a particular area. Your home’s risk may be higher or lower for flooding depending on where it is in the zone as well as several other factors. Homes having a 1 percent annual risk of flooding means that over the course of a 30-year mortgage, there is a 26% chance that home will flood.

Even if your home is in a lower risk category and flood insurance is not required, you may want to consider adding it to your coverages. According to FEMA data, roughly 25 percent of all flood insurance claims come from areas with low-to-moderate flood risk.

The National Flood Insurance Program (NFIP) will sell policies to homeowners in any of the flood zones, you don’t have to live in a high-risk area to purchase a policy from the NFIP. Flood insurance is also available in the private market.

Am I required to purchase flood insurance?

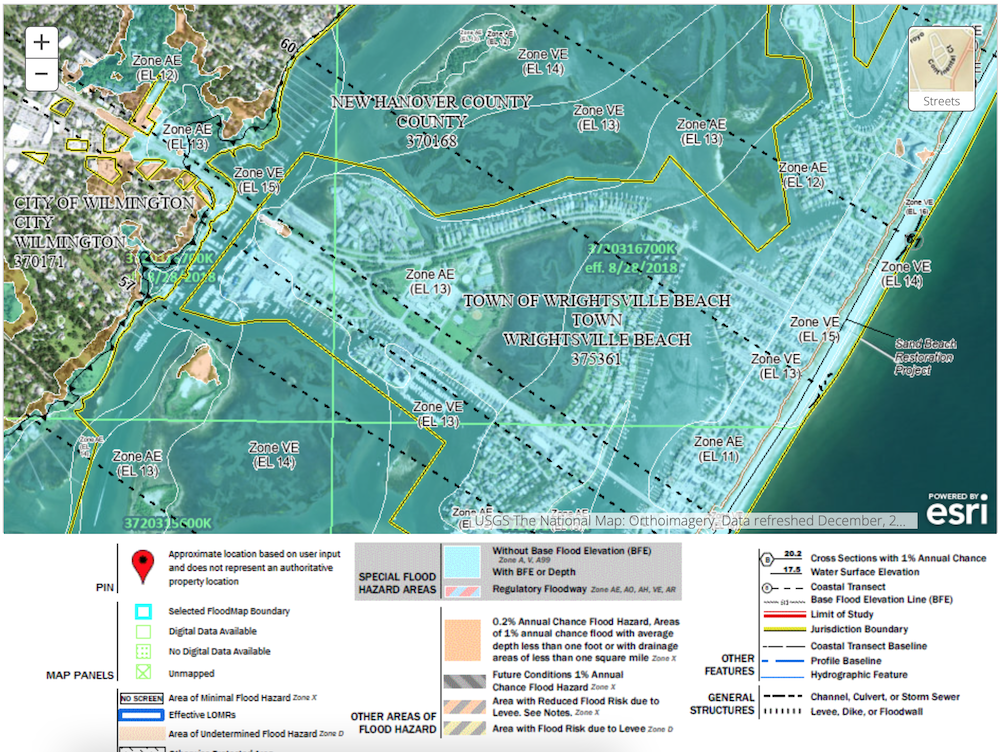

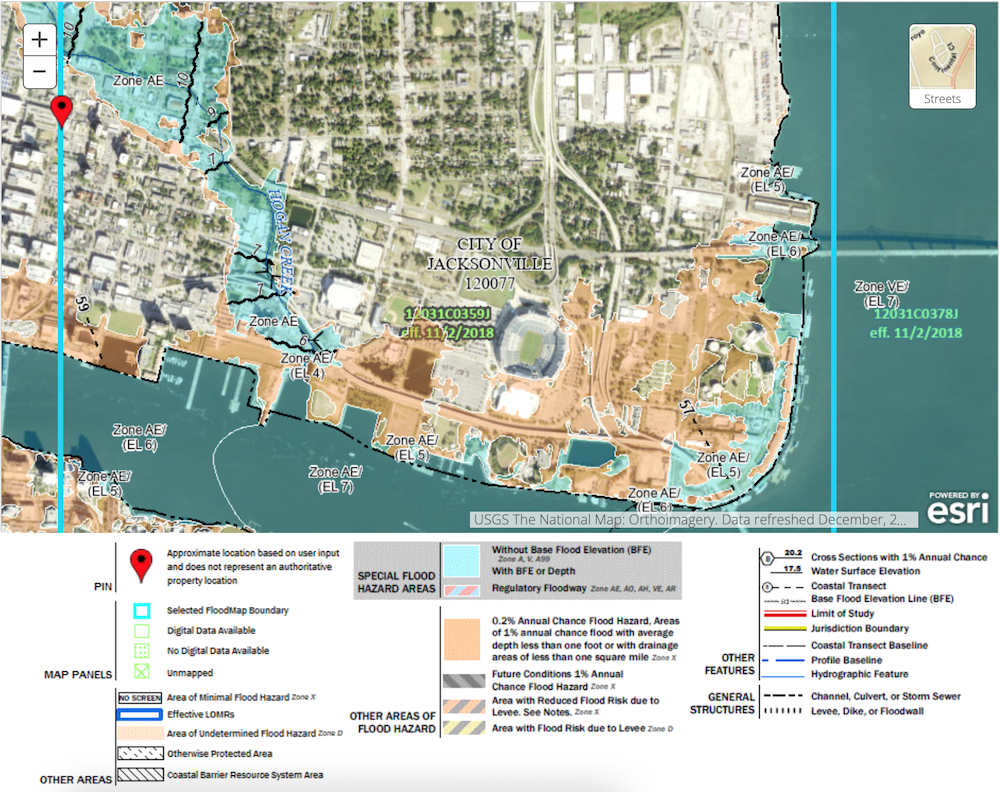

The best way to answer that question is to look at FEMA’s Flood Insurance Rate Map (FIRM) to look up your property and see which flood zone your fall into. If your home covers more than one flood zone, and one of those zones requires flood insurance, while the other one doesn’t, you will need to purchase flood insurance, it is based on the most hazardous zone your home is in.

How does the NFIP determine flood insurance rates?

In the past, your flood insurance premium would be based solely on where your home fell on a flood insurance map. Unfortunately, this was not the most accurate way to set premiums as flood zones can be large and where your home is located in the zone, along with other factors such as your property’s elevation can make a huge difference in the odds of your home flooding.

This led to inaccurate premiums with some homeowners (coastal properties) often paying premiums that did not accurately reflect the real risk of flooding that their home presented, while more inland homeowners were paying more than their fair share based on their homes risk of flooding.

FEMA and the NFIP recently revamped how flood insurance premiums are calculated. They call the program Risk Rating 2.0. While the new method still looks at the zone the home is located in, it also takes into account data that is specific to your property. This results in a more accurate and fairer premium.

Risk Rating 2.0 uses a variety of factors to set a flood insurance rate, a few of the new factors being considered:

- Nearby rivers that may overflow

- Frequency and severity of storm surge

- Frequency of heavy rain

- Local coastal erosion

- Distance from a water source

- The size of the home and cost to rebuild

- Home’s foundation type

- Height of your first floor

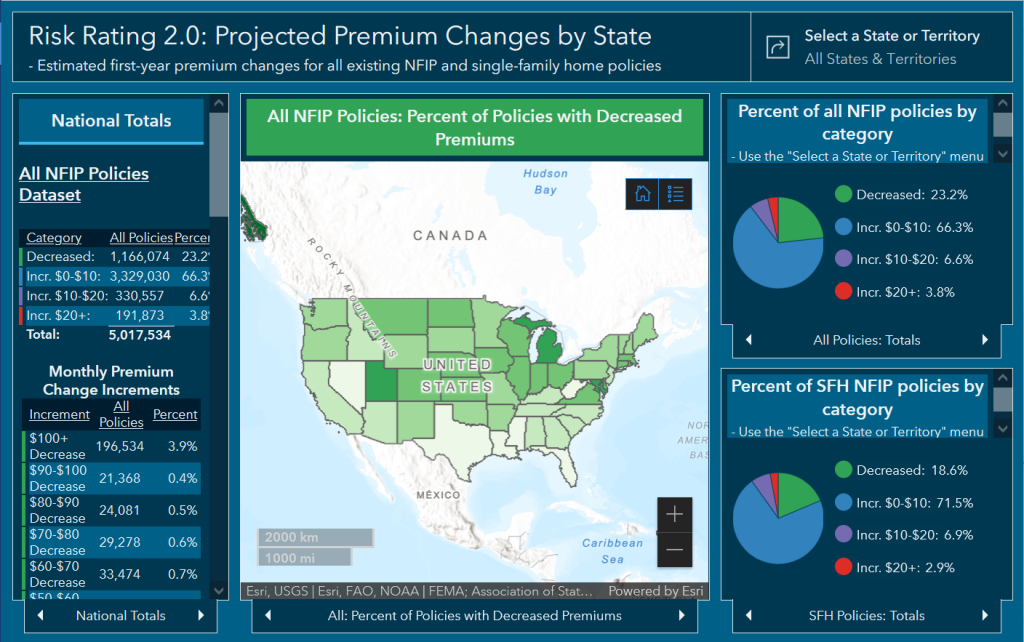

This has led to a premium increase for many coastal homeowners while more inland properties have seen a premium decrease. FEMA projects the following when it comes to rate increases and decreases due to Risk Rating 2.0:

- 23% of current policyholders will experience a premium decrease

- 66% will see an increase of up to $10 per month

- 7% of current policyholders will experience a $10 to $20 per month increase

- 4% will see a monthly increase over $20

What is a flood factor?

FEMA and the NFIP assign a flood factor which is the likelihood of the property flooding over a 30-year period (typical mortgage) as well as the likelihood of one inch of water will reach your home. Ratings are from 1 to 10 with a higher score meaning you are more likely to experience a flood. Flood factors are not currently being used by the NFIP to calculate your premium.