Update on Irma: Florida’s Home & Flood Insurance Coverage Options

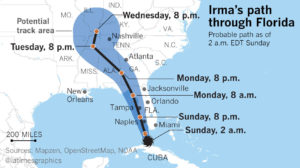

Irma Passing through Florida, then Alabama and Georgia on Monday, September 11, 2017

Hurricane Harvey has done a massive amount of damage, in fact it is too early to even get a sense of the total costs of this hurricane. Adding insult to injury is the fact that Hurricane Irma is now bearing down on the Florida Keys and parts of mainland Florida.

If your home is located in the path of Irma you could see extensive wind and flood damage and if you don’t have a separate flood insurance policy you may be on the hook for all flood related expenses.

A standard homeowners insurance policy will not cover damage done by flooding so it is important to carry a separate flood insurance policy if you live in a flood prone area, this can be especially relevant in the Sunshine State.

Homeowners Insurance Doesn’t Cover Flood Damage

Unfortunately, as many homeowners in Texas are discovering, homeowners insurance does not cover damage caused by floods or floodwaters. While wind damage is very common when it comes to hurricanes, flood damage is often more extensive and expensive to repair.

A typical homeowners insurance policy will cover flooding caused by rainwater but not rising waters. This is an important distinction to understand. If for example, your room is blown off or damaged by hurricane winds and your possessions are damaged or destroyed due to flooding in your home caused by rain entering through the hole in the roof, this damage would be covered.

On the other hand, if a nearby river, lake or ocean overflows and causes flooding in your area this is considered flooding due to rising waters and this is not covered. It should be noted that rising waters are responsible for the majority of flooding and flood damage.

If your home is flooded or damaged by rising flood waters and you are not carrying a separate flood insurance policy the cost to repair your home and replace your possessions will fall to you and this can be a very expensive repair.

Rising water flood damage is never covered regardless of the source of water. Flooding can occur from storm such as a hurricane or even oversaturated ground as well as overflowing bodies of water such as ponds, oceans, lakes and rivers. It makes no difference where the rising water came from, if it enters your home and damages your property a standard homeowners policy will not cover the damage.

Can I Get Coverage?

If you are staring down Hurricane Irma and live in Florida or any other state it may hit, you may be out of luck to get coverage before the storm hits. The majority of flood insurance policies are written by the National Flood Insurance Program (NFIP), which has a 30-day waiting period for new policies.

However, there are numerous private insurance companies in Florida that write flood insurance policies outside of the National Flood Insurance Program. Each insurer will have their own parameters in regards to their policies so you may be able to get coverage before Hurricane Irma makes landfall.

There is no guarantee of coverage and you will need to meet the insurers specifications as far as qualifying for the policy. The location of your home will definitely have an impact on their decision to insure you or not.

According to the Florida Office of Insurance Regulation’s website there are currently about 20 private insurance companies offering flood insurance policies in the Sunshine State.

It’s important to remember that some of these companies may only write limited policies and that flood insurance can be an expensive coverage but it can be a financial lifesaver if your home is damaged by flood waters.

Limitations of Flood Insurance

Flood insurance written by the National Flood Insurance Program does come with limitations. Coverage limits are set at $250,000 for damage to your home and $100,000 for damage to your personal possessions and contents.

Pricing for a NFIP policy will vary depending on where your home is located. Pricing is set by the Federal Emergency Management Agency (FEMA) and is nonnegotiable. Pricing is set on a regular basis and can go up or down depending on current flood zone maps.

Private insurance company policies may have different coverage levels and pricing may end up being less expensive or more expensive, it is totally at the discretion of the insurance company.

If you are in need of a flood insurance policy you should shop both the NFIP as well as private insurance companies. It’s important to remember that the NFIP has a 30-day waiting period so this is not an option if you are hoping for protection from Irma.

While we all think that it will never happen to us, flooding does happen and can be financially devastating if you are not properly insured as Hurricane Harvey has demonstrated. CoreLogic, a property analytics firm, has estimated that roughly 70 percent of the flooding damage in Texas will not be covered by insurance.

Don’t wait until it is too late, research your flood insurance options now.