Miami Homeowners Face Rising Flood Insurance Rates

“The local flood zones defined by FEMA in high-risk coastal regions provide a great deal of exposure data for homes in the path of flood waters, but understanding the additional layer of risk posed by a storm surge is critical for homeowners, emergency response teams, insurance companies and many others to plan and prepare for natural catastrophes,” said Dr. Howard Botts, executive vice president and director of database development for CoreLogic Spatial Solutions.

According to a study published by the World Bank, Miami is one of the ten cities in the world that face the greatest risk of extensive flooding as sea levels rise due to climatic changes. As per the numbers quoted in the study, Miami is also likely to suffer the most in terms of economic damage due to flooding. Miami homeowners may not be too surprised at these findings because every year, parts of Miami go under ankle- and knee-deep water during the hurricane season and after a spell of heavy showers. But they will soon have to worry about the rising flood insurance rates.

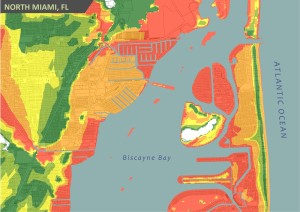

A standard homeowner’s insurance policy in Miami does not offer flood damage coverage. So homeowners here and especially those who live in areas designate as flood hazards by the National Flood Insurance Program (NFIP) buy additional flood insurance policies. These areas include coastal areas like the South Beach region and those near the Miami River and the many canals that criss-cross Miami. Some other flood-prone areas of Miami include the Alton Road, the stretch of 5th Street between Alton and Michigan roads, and that between 5th Street and Lincoln Road.

Understanding the Dynamics of Rising Flood Insurance Premium Rates

According to a report published in the Miami Herald, homeowners will see a rise in the premium amounts they pay for their flood insurance policies in the coming months. Not everybody will be affected equally though. For instance, many owners of older homes who are currently enjoying insurance subsidies under the NFIP will lose their privileges and face phased increases in the premium amounts.

Individuals who own secondary residences in the flood-prone regions of Miami will also face a rise in the flood insurance premium amounts that they shell out. The increase is projected to be at around 25 percent annually until the time the rate is at par with the risk rate. In this context, it is also worth clarifying that prospective homeowners who choose to buy older homes will also have to pay the increased premium prices.

For the uninitiated, these imminent developments are as per the guidelines of the Biggert-Waters Act. The Act has been executed to stabilize the federally-funded NFIP that is currently operating with a deficit of $ 24 billion.

Tips for Miami Homeowners to Counter the Rising Flood Insurance Rates

Not all is pall and gloom for Miami homeowners who live in flood-prone regions. The rate of increase in the flood insurance premiums will depend on the perceived flood risk of a particular area. For instance, those who live in regions that have been designated as Special Flood Hazard Areas with 1 percent or more chances of flooding in a year have to pay more in premiums than those who own properties in areas with lesser flooding risk.

So find out if your home lies in an especially hazardous area and if you think that you have been slapped premium rates that are unduly high, consider challenging them. On the other hand, prospective homeowners may consider scouting for homes in Miami areas that are not particularly flood-prone to avoid spending more in flood insurance premiums.

Florida Homeowners Insurance Quotes

For Florida residents, it’s not uncommon to shop for quotes to discover the best rates and coverages options for your home. Take advantage of our online services and get multiple quotes from one agent who you can count on and trust to help you compare quotes and explain the coverage options to you.