Homeowners Insurance Survey Shows a Drop Due to Claim Satisfaction

J.D. Power speculated that the drop in client satisfaction might be due to insurers cutting back on customer service spending due to declining profitability in the homeowners insurance market.

According to a recent J.D. Power and Associates report, satisfaction among homeowners who have made claims on their homeowner polices has declined for the first time in five years.

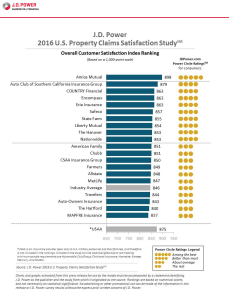

The J.D. Power survey included over 5,700 homeowners who made a property claim on their homeowners insurance in 2014 and 2015. Satisfaction levels range from 837 to 898 on a 1,000-point scale and the average came in at 846. This is a five-point drop from last year’s average score of 851.

Respondents were asked about their satisfaction on a number of factors. The factors included final settlement amount, the initial response to their loss notification, the estimation process, customer service and the repair process.

J.D. Power speculated that the drop in client satisfaction might be due to insurers cutting back on customer service spending due to declining profitability in the homeowners insurance market.

Declining premium rates have put pressure on profitability forcing some insurers to shift resources from customer service, as a way to reduce costs. This may be the cause of the decline in overall claim satisfaction.

Dissatisfaction with the claims process after significant weather events had a major impact on overall satisfaction. Winter storms that bombarded the Northeast in 2015 and hail damage in Colorado and surrounding states were big factors in the study results.

Here are just a few of the key findings:

Satisfied Customers Renew: Customers who ranked their experience as “highly satisfied” were much more likely to renew their policy than less satisfied customers. A whopping 81 percent of “highly satisfied” claimants said they “definitely will” renew their policy.

Customers who were “dissatisfied” with their experience were much less likely to renew and may have already switched insurance companies. Only 14 percent of “dissatisfied” customers said they “definitely will” renew and 13 percent had already switched insurers due to their claim experience.

Younger Claimants Need Help: According to the study, younger homeowners would like more help when it comes to finding a contractor to repair their home. A significant 31 percent of younger policyholders said they wanted help selecting a contractor.

Non-Weather Related Claims Are Big: In 2016, non-weather claims that involved water damage were the most frequent type of claim, but satisfaction levels were not high. Non-weather water damage claims recorded a satisfaction level of 835, which was a drop of 19 points.

The Best of the Best

If you are looking for the best experience when it comes to making a property claim on your homeowners coverage, you can’t go wrong with these companies.

Amica Mutual comes in first for the fifth year in a row with a score of 898. Amica ranked high in all factors.

Auto Club of Southern California Insurance Group managed a second place showing with a score of 879.

Erie Insurance, Country Financial and Encompass tied for third with a score of 863.

If you are dissatisfied with your current insurer, we can help you shop multiple coverage and rate options. Please click “Get Free Homeowners Insurance Quotes Now” and enter your zip code to start our quick online home insurance quoting application.